April Wages, Work Hours, Spending, and Borrowing

Over the past 3 weeks, MFO and SANEM have been conducting phone interviews with 800 of the workers who participated in the Garment Worker Diaries project last year. The interviews took place on Friday, Saturday, and Sunday of each week. We are still doing some checking on a small number of respondents, but we have 787 respondents for whom we have data for all three weeks.

These are some of the findings:

Wages

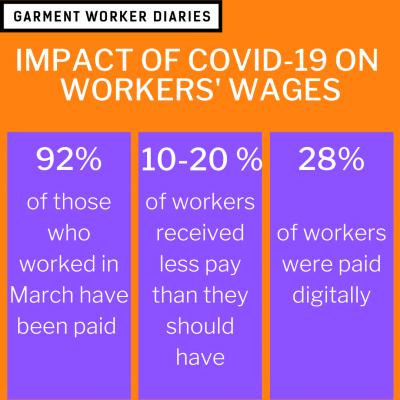

- Wages paid: 92% of those who worked in March have now been paid. This is up from 86% last week—41 additional respondents reported being paid for March work this week.

- Partial wages: We estimate that between 10% and 20% of workers received less pay than they should have. Looking just at this past week’s data we see one respondent who was only paid Tk. 2025 this month but at this time last year was paid Tk.8150, and another that was paid Tk.4000 but last year was paid Tk.10,500.

- Digital wages: 28% of workers were paid digitally, across the three weeks of data.

Food security

- 83% of workers reported eating less than they feel they should because of money shortages this week—these answers are consistent with the answers we got last week and the week before.

Injuries and illness

- Illness: in 5% of the interviews conducted this week workers reported an illness in the family (including themselves), this is down from 14% in the previous 2 weeks.

- Injury: in only 2% of interviews across the three weeks did workers report suffering an injury.

Work Hours

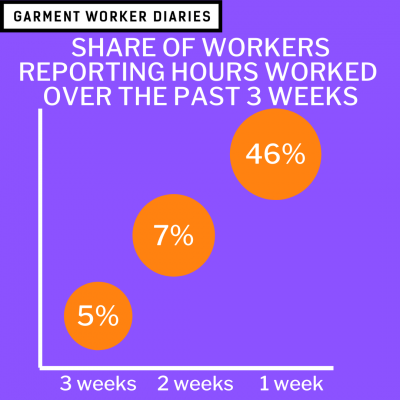

In addition, we have been tracking the workers’ work hours and we are seeing a large increase in the share of workers reporting that they worked last week:

- 46% said they worked some hours last week, as compared to 7% the week before and 5% the week before that.

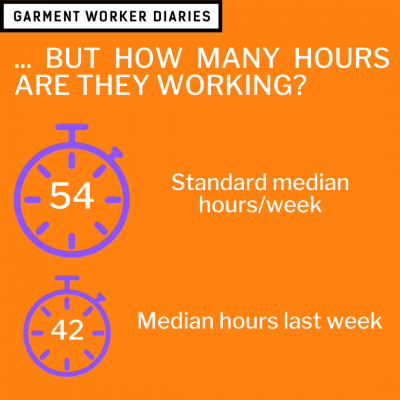

- The median number of hours worked last week was 42 hours (this number includes any time allocated for breaks and is well below the standard of 54 hours).

Financial Transactions

Finally, we have started to look at some other factors such as the extent to which workers are borrowing or tapping into social networks for support or changing their spending. Given the prevalence of salary payments we should not expect much change in behavior when we compare the workers to their behavior in April 2019, but we may see changes because of changes in behavior of those around them. What we found was the following:

- Rent payments—the rate of rent payments this year are a little below rent payments last year. Last year 69% of the respondents in our current pool reported paying rent in April (not all report paying rent because someone else in the household covers it and there are also times when they just don’t pay it for some reason); this year 64% did.

- Cash transfers received—there has been a considerable drop in the share of workers receiving a transfer from outside the household from 34% last year to 10% this year. This may reflect the fact that the workers’ networks are in stress more so than the workers themselves.

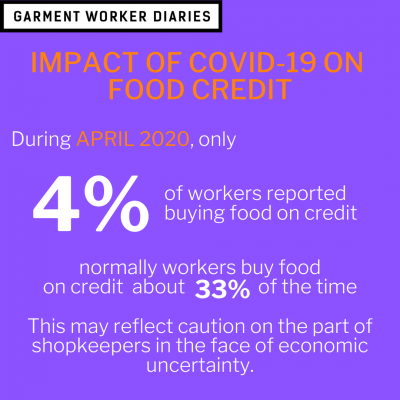

- Food purchased on credit—normally workers buy food on credit during the month about 1/3rd of the time, but this April only 4 percent of them reported buying food on credit. This may reflect caution on the part of shopkeepers in the face of economic uncertainty, but we will have to check this.

- Rates of borrowing other than food on credit seem to be about the same as normal, but all of that borrowing is within social networks and not from any type of financial institution.

This coming weekend we are scaling to 1,300 workers. This coming weekend is also a critical time because many workers will be expecting to be paid for work performed in April and others will be expecting a payment funded through a loan from the government to their employer, which will be paid digitally. We will be able to tell you next week how those pay outs have gone.