Our previous two blogs discussed economic resilience, defined it within the context of the Garment Worker Diaries as a measure of food security, and then dug a bit deeper into the relationship between food security and digital bank or mobile money account ownership during COVID-19 in Bangladesh.

Having shown that workers who had acquired a digital bank or mobile money account before the onset of the COVID-19 pandemic were a bit more food secure than their peers, we are going to explore the data even more for this blog to try to understand why that might be.

Note: Banner photo of clothesline courtesy of a garment worker in Savar

Looking deeper into the data, we observed two money management behaviors that suggest why workers with more experience with digital accounts might be more economically resilient—the management of cash transfers and savings.

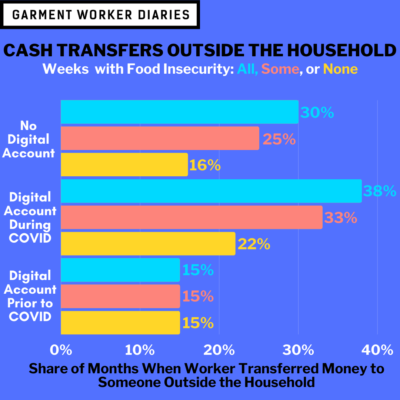

Cash transfers to someone outside the household have a complex relationship to food insecurity and the timing of the acquisition of a digital account. Those with experience with digital accounts were less likely to transfer money to others outside the household than other workers. Those with less experience with digital accounts were the most likely to transfer money to someone else and to do so when they were food insecure than when they were not. Those without a digital account fell between the two other groups in terms of transfer behavior. What these data suggest is that workers with some experience with a digital account were better able to manage the amount and timing of their transfers to others.

In the weekly GWD interviews, workers reported instances when they withdrew money from their savings. This is very common among workers, because they are paid monthly and then draw down their salary, which they keep in savings during the month.

Workers who reported withdrawing money from a digital savings account (mobile wallet or bank account) in a month, were more likely to be food secure during that month than workers who only withdrew money from a cash account (savings kept at home) in a given month. Workers who did not withdraw money at all could be facing one of two situations: 1) unable to withdraw money because they did not have any; 2) not needing to withdraw money because they had cash on hand. The data suggest that, on balance, the former situation prevailed.

Looking more closely at the data on savings, we found that workers who had experience with digital accounts were far more likely to withdraw money from such a digital account in months when they were food secure than other workers.[1] This suggests that workers with these types of account were using their savings to cover their living expenses.

All of this suggests that workers who had an account pre-COVID were better prepared to use the account to manage their money when the pandemic hit, enabling them to bounce back more quickly.

[1] It is possible for a worker to report withdrawing money from a digital account even if they do not report having such an account. There may be someone else in their household who has an account that the worker used. But the numbers are very small.

The data for the analysis presented here came from a subset of 732 workers in April 2020 and a subset of 1,269 workers from May 2020 onwards. These workers are employed in factories spread across the five main industrial areas of Bangladesh (Chittagong, Dhaka City, Gazipur, Narayanganj, and Savar). Just over three-quarters of the working respondents are women, roughly representative of workers in the sector as a whole.