In May we asked workers about their experiences with digital wage payments. We asked the same questions in September and though, overall, the share of workers paid digitally in September had dropped to about 61% from about 76% in May, many of the answers were still the same. But there were some changes in what women workers were able to do with their digital accounts. Furthermore, those changes varied depending on the education level and age of the women. More educated women were more likely to have learned how to do more things with their digital accounts, with the same being true for younger women. It is also the case that the younger women in our sample tend to be better educated so we will need to dig deeper into our data to see whether age or education are more closely associated with changes in the use of digital accounts.

In May, 53% of the women receiving digital payments reported that they could withdraw money from their digital accounts without help and 55% said they could check their balance without help. By September those numbers had changed: 65% of women workers reported being able to withdraw money and 70% reported they could check their balances without help.

In contrast, there was little change in the share of women who reported they could transfer money without help. In May 25% said they could and in September this number had only moved to 30%. There was also no change in their reported level of comfort with the digital financial services system overall: 63% and 65% reported being comfortable with the system in May and September respectively.

Because we are talking with the same workers each week, we are able to look at how the women workers switched their responses from May to September. To do this we matched up all the women who answered our questions in both months—457 in total. We then focused on those women who said they could not withdraw money, check a balance, or make transfer without help in May to see how many had switched their answers in September to say that they could. There were women who went the other way saying they could do something in May but could not do it in September and those women affected the overall changes in the reported ability of women to make transfers on their own, but not on withdrawing cash or checking a balance.

About half of the women switched their answers from “No” to “Yes” when asked if they could withdraw money without help or could check their own balance. Only about 20% of women switched their answer from “No” to “Yes” with respect to being able to make a transfer. And this positive movement was counter-balanced by a number of women saying they could not carry out a transfer without help even though they said they could in May.

Below is the breakdown for respondents who answered “No” to being able to perform a digital task on their own in May, and those same respondents’ corresponding answers in September:

|

In May, said NOT able to… |

In September, said… |

|

|

Able to |

Not able to |

|

|

Withdraw |

43% |

57% |

|

Check balance |

48% |

52% |

|

Transfer |

19% |

81% |

When we break down the data by education and age, some interesting patterns emerge:

- The more educated a woman worker, the more likely she was to switch from saying she could not withdraw money without help to saying that she could.

- About 32% of women with no education switched their answer, rising to just over 40% for those with primary education, to almost 50% for those with secondary or more education.

- The more educated a woman worker, the more likely she was to switch from saying she could not check her balance without help to saying that she could.

- About 28% of women with no education switched their answer, rising to just over 47% for those with primary education, to almost 66% for those with secondary or more education.

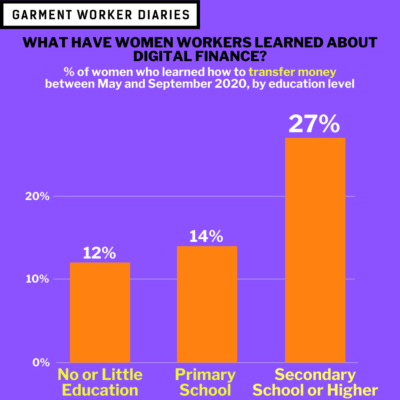

- The most educated women, those with some secondary education or more, were more likely to switch from saying they could not transfer money without help to saying that they could.

- About 27% of these most educated women switched their answer, but those with only primary or no education only switched their answers in about 12% to 14% of cases.

The story with respect to age shows younger workers more likely to report that they had learned how to withdraw money, check their balance, and transfer money:

- About 50% of the women under 35, which we split into two age cohorts of 18 to 24 and 25 to 34, switched from saying they could not withdraw cash without help to saying they could, but under 33% of women 35 and over switched their answers.

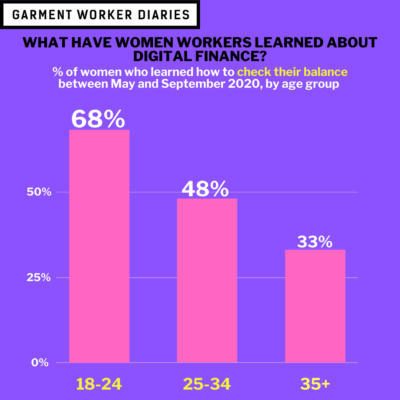

- The younger a woman worker, the more likely she was to switch from saying she could not check her balance without help to saying that she could.

- 68% of those 18 to 24 switched their answer, dropping to just over 48% for those 25 to 34, and then dropping further to about 33% of women 35 and over switching their answers.

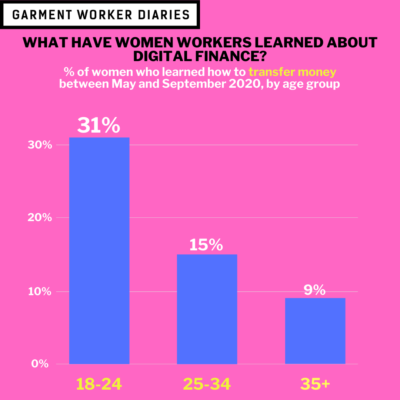

- And, finally the youngest women, those 18 to 24, were more likely to switch from saying they could not transfer money without help to saying that they could.

- About 31% of these young women switched their answer, but only 9% and 15% of their elders in the next two age cohorts, respectively, switched their answers.

The education and age of the women who answered our questions in both May and September map each other fairly closely, with younger women being more educated. This means that separating out the effects of age and education is hard. We did take one step further in our analysis to use more sophisticated statistical techniques and the results suggest that age may be trumping education, but it is hard to say without further analysis.

The data presented here come from the 457 women respondents who were able to answer our questions about their experiences with digital wage payments in both May and September 2020. All interviews were conducted over the phone. These workers are employed in factories spread across the five main industrial areas of Bangladesh (Chittagong, Dhaka City, Gazipur, Narayanganj, and Savar).