In late December last year we asked garment workers in Bangladesh to give us a bit more info than usual on their household savings practices. We wanted to know how many workers co-mingle their savings and how many save money apart from others; whose savings are mixed with whose; and whether or not household members inform each other when they withdraw from shared savings, among other questions. In this blog we are going to look at some of what the workers told us, and in the coming weeks we will dive more deeply into their answers as a way to understand gender dynamics around the management of household savings.

To provide some context for these answers, let’s start by bringing the Garment Worker Diaries’ household earner data up to date through the end of March 2021, so we can get a sense of who in the household can be contributing towards shared savings, what those people are doing for work and just how much they are earning.

Household Earner Work Hours, Wages and Demographics

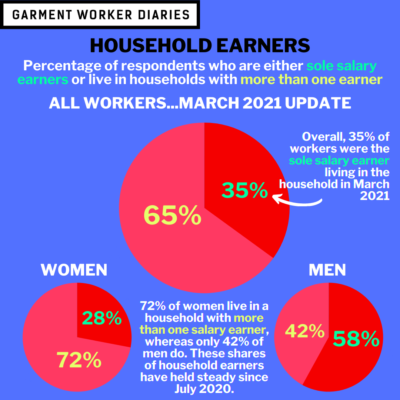

In March 2021 the proportion of garment workers in our study who were the sole household earner was very similar to our previous data updates: 35% of garment workers were the sole household earner in March 2021 compared to 33% and 34% in December and July 2020, respectively.

Among the respondents who did live with additional household earners and gained consent to discuss household finances with us, those other household earners were as gainfully employed in March 2021 (98% of other earners worked that month) compared to December and July 2020 (when 97% and 96% worked, respectively). The median hours worked by other household earners in those months was also nearly identical (240 hours in March 2021 and 243 and 239 hours in December and July 2020, respectively).

Likewise, the median salary earned by other household earners has also been very stable, at Tk. 10,500 in March 2021 and Tk. 10,000 in both December and July 2020. The median salary for women was Tk. 10,000 in all three months, while the median salary for men varied: Tk. 11,000 in March 2021, and Tk. 10,000 and Tk. 9,000 in December and July 2020, respectively.

In terms of who was doing the earning and what their jobs were, these demographics have also remained very stable and are displayed in the two charts below.

Proportional Breakdown of Other Household Earners

|

Household Member |

Mar-21 |

Dec-20 |

Jul-20 |

|

Spouse |

76% |

74% |

71% |

|

Son |

5% |

6% |

5% |

|

Brother |

4% |

5% |

6% |

|

Father |

5% |

5% |

6% |

|

Mother |

3% |

3% |

4% |

|

Sister |

3% |

3% |

6% |

|

Daughter |

2% |

2% |

2% |

|

Other |

1% |

1% |

1% |

|

Brother-in-law |

0% |

0% |

0% |

|

Cousin |

0% |

0% |

0% |

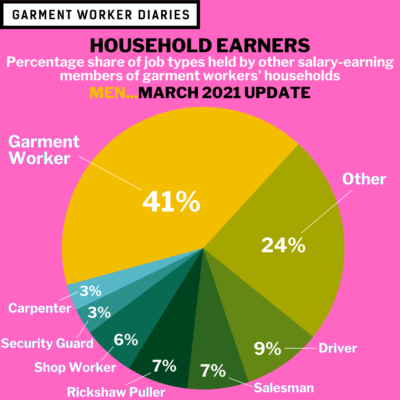

Proportional Breakdown of Other Household Earner Job Types

|

Type of Job |

Mar-21 |

Dec-20 |

Jul-20 |

||||||

|

Overall |

Women |

Men |

Overall |

Women |

Men |

Overall |

Women |

Men |

|

|

Garment Worker |

50% |

89% |

41% |

51% |

87% |

42% |

51% |

87% |

42% |

|

Driver |

7% |

1% |

9% |

7% |

0% |

9% |

5% |

0% |

7% |

|

Carpenter |

3% |

0% |

3% |

2% |

1% |

3% |

3% |

0% |

3% |

|

Salesman |

6% |

0% |

7% |

6% |

0% |

8% |

5% |

0% |

7% |

|

Shop Worker |

4% |

0% |

6% |

4% |

0% |

5% |

2% |

0% |

3% |

|

Rickshaw Puller |

6% |

0% |

7% |

5% |

0% |

6% |

7% |

0% |

9% |

|

Security Guard |

2% |

0% |

3% |

3% |

0% |

4% |

3% |

0% |

4% |

|

Other |

21% |

10% |

24% |

22% |

12% |

24% |

23% |

13% |

26% |

Household Savings Practices

When we asked garment workers whether the money they kept at home as savings was mixed in with other household member’s savings or whether their savings was kept separate, 44% of workers told us that they co-mingled their household savings, and the other 56% said they kept their savings separate. There was no difference in the rate at which men and women reported co-mingling their savings with other members of their household—45% of women compared to 42% of men said they co-mingled their savings.

Unsurprisingly, when we asked these respondents with whom their savings were co-mingled the most common household member named was “spouse” at a 72% response rate. “Parents” was the second-most named co-saver with a 15% response rate, and other household members (“children”, “brother”, “sister” and “other” in descending order of response rate) made up the remainder of the responses.

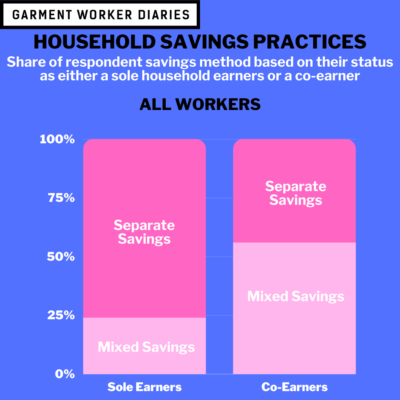

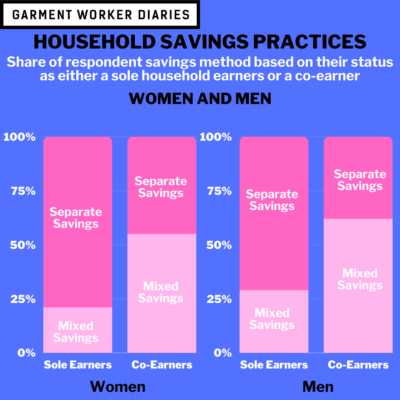

There is a clear difference in how workers who are the sole earners in their households manage their savings when compared to workers with other earners in their household: 76% of workers who are sole earners told us that they keep their savings in a separate account, while 44% of workers who have other earners in their household do so. There is little difference between women and men in this regard: 79% of women who are sole earners reported keeping their savings separate, while 71% of male sole earners did so; and 45% of women with other earners in the household reported keeping their savings separate, while 38% of men with other earners in the household did so.

What we are hearing from the workers is that women and men in the same household situation manage their savings in similar ways. In a future blog, we are going to look at this more closely, by examining what the workers told us about how they co-mingle their funds and who has access to funds that are kept separately.

The household earner data presented here come from interviews conducted over the phone from July 2020 through March 2021 with a pool of 1,294 workers. The savings data presented here come from interviews conducted over the phone in late December 2020 with a similar pool of 1,292 workers. These workers are employed in factories spread across the five main industrial areas of Bangladesh (Chittagong, Dhaka City, Gazipur, Narayanganj, and Savar). Just over three-quarters of the working respondents are women, roughly representative of workers in the sector as a whole.