Before COVID-19, most garment workers in Bangladesh received wage payments from their factories in cash. Immediately after COVID-19, most garment workers started receiving their wages digitally. Now in the eighth month of the pandemic, a diminishing majority of workers are receiving digital wage payments, and an increasing minority are still receiving or have reverted to receiving cash payments (a very small share gets paid with a mix of cash and digital money).

This near-universal opportunity for garment workers to experience receiving digital wages has been unprecedented. And with eight months to reflect on their journey, MFO and SANEM wanted to know if garment workers had accumulated any preferences for cash or digital payments, and what sort of attitudes, if any, they’d cultivated towards the two forms of payment. Here’s what they told us:

Note: respondents could agree, disagree, strongly agree, strongly disagree, or neither agree nor disagree with a survey prompt (or select that the prompt was not applicable to them). Because most respondents selected either “agree” or “disagree”, we will conflate “strongly agree” and “strongly disagree” with “agree” and “disagree”, respectively, unless otherwise specified.

Safety Concerns with Cash vs. Digital Payouts

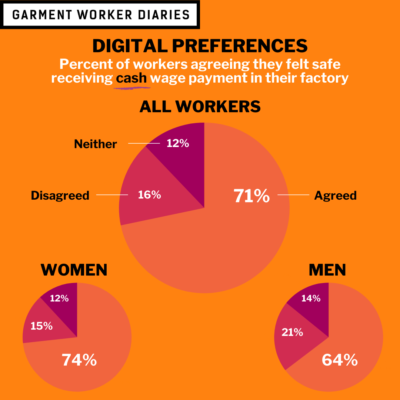

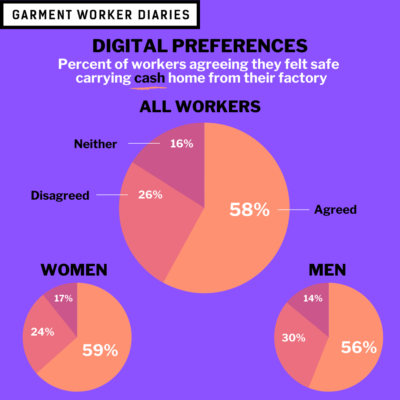

We asked garment workers if they felt safe when being paid in cash inside their factory, and if they felt safe carrying that cash back home. The majority of workers felt safe both receiving cash in the factory and carrying it back home, with women more likely than men to say they felt safe in both scenarios:

- 71% of respondents agreed with the statement “When I am/was paid in cash I felt safe receiving the money in the factory”

- 74% of women said they felt safe compared to 64% of men

- 58% of respondents agreed with the statement “When I am/was paid in cash I felt safe carrying the cash from the factory to my home”

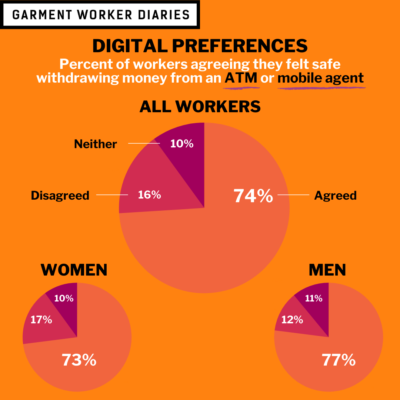

For garment workers who receive digital wages, the majority head to the ATM or a mobile money agent and withdraw all or nearly all of it in cash. These respondents also said they felt safe both withdrawing cash and carrying it home, this time men being slightly more likely to feel safe:

- 74% of workers agreed with the statement “When I am/was paid digitally I felt safe withdrawing the money from an agent or ATM”

- 73% of women said they felt safe compared to 77% of men

- 69% of respondents agreed with the statement “When I am/was paid digitally I felt safe carrying the cash from the agent/ATM to my home”

- 68% of women said they felt safe compared to 73% of men

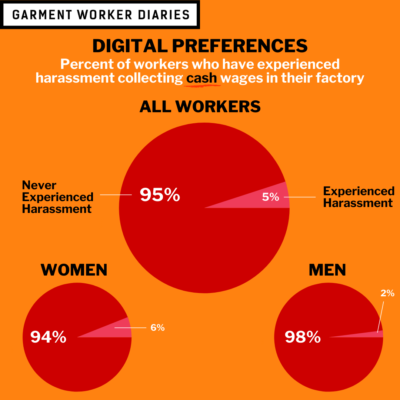

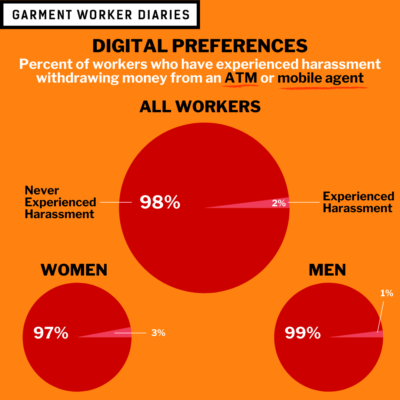

Harassment During Wage Collection

The good news here is that the vast majority of workers, both women and men, report that they themselves have never experienced harassment when either collecting cash wages in their factory, or when withdrawing wages at a mobile money agent or an ATM. However, workers were slightly more likely to have witnessed harassment than to have experienced it, and women were slightly more likely than men to have both experienced and witnessed harassment:

- 98% of respondents have never experienced harassment withdrawing wages at a mobile money agent or an ATM compared to 95% of respondents who have never experienced harassment collecting wages in cash at their factory

- 97% of respondents have never witnessed harassment while withdrawing wages at a mobile money agent or an ATM compared to 94% of respondents who have never witnessed harassment while collecting wages in cash at their factory

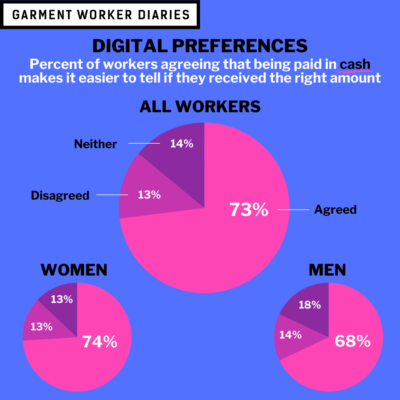

Knowledge of and Control over Finances

When it comes to knowing how much they are getting paid, having control over, and making decisions about their own finances, garment workers are mixed in their attitudes towards cash vs. digital payments. The picture is yet slightly more mixed when comparing women’s attitudes to men’s attitudes.

Garment workers are more likely to say it is easier to know if they have been paid the correct wage when receiving cash vs. digital payments:

- 73% of respondents agreed with the statement “Being paid in cash makes it is easy to know if I got paid the right amount” vs. 57% of respondents who agreed with the phrase “Being paid digitally makes it is easy to know if I got paid the right amount”

Garment workers are slightly more likely to say that they have more control over their finances if receiving wages digitally vs. cash, but this is driven by gender differences:

- 62% of respondents agreed with the statement “Being paid digitally gives me control over my money” vs. 60% who agreed with the statement “Being paid in cash gives me control over my money”

- 59% of women agreed that digital payments gave them control over their money and roughly the same share also agreed that cash gave them control over their money

- On the other hand, 70% of men said that digital payments gave them control over their money, far more than the 56% of men who said that cash did

Garment workers were about as likely to agree that being paid digitally or in cash enabled them to be more involved in household spending decisions. However, women were less likely than men to agree that being paid either digitally or in cash offered them more involvement in household spending decisions. And in terms of agreeing with the statement “Being paid digitally has enabled me to be more involved in household spending decisions”, 51% of women agreed with the statement compared to 64% of men who agreed.

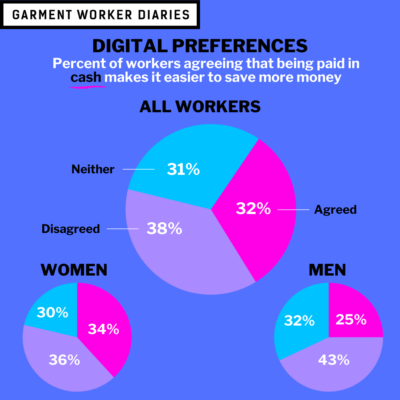

Saving for the Future

We asked workers whether how they were paid affected their ability to save. The results suggest that workers see digital payments as more likely to enable them to save. For these savings data, we analyzed survey results from respondents who had experience receiving cash and digital wage payments at some point in their jobs. This dual perspective yields important legitimacy to the expressed cash vs. digital preferences:

- 31% of respondents agreed with the statement “I can save more money now as a result of receiving my salary in cash”, while 44% of respondents agreed with the statement “I can save more money now as a result of receiving my salary through a digital payment system”.

There were differences in responses from men and women, with men being more likely to point to digital as an enabler of savings than women:

- Only 21% of men agreed that being paid in cash enabled them to save more, but 54% of them agreed that being paid digitally enabled them to do so.

- The pattern was the same for women, but the differences between cash and digital payments was less stark: 34% of women agreed that being paid in cash enabled them to save more, and 41% said the same about digital payments.

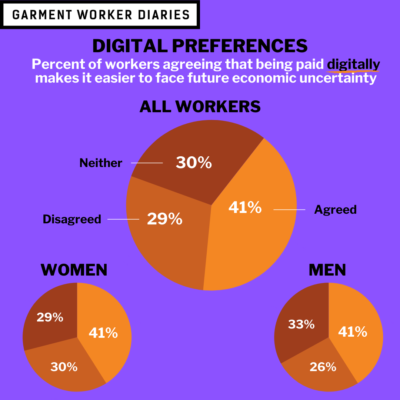

Garment workers are only slightly more likely to agree that digital wage payments allow them to absorb future unexpected economic traumas, with the agreement driven largely by men:

- 41% of respondents agree with the statement “Being paid digitally has enabled me to be prepared to face an unexpected economic hit” vs. 39% who agree with the statement “Being paid in cash has enabled me to be prepared to face an unexpected economic hit”

- The same share of women as men, 41%, agreed that digital wage payments allow for greater future economic preparedness

- 42% of women agreed that cash wage payments allow for greater future economic preparedness compared to just 28% of men who said the same

The data presented here come from interviews conducted over the phone with a pool of 1,283 workers. These workers are employed in factories spread across the five main industrial areas of Bangladesh (Chittagong, Dhaka City, Gazipur, Narayanganj, and Savar). Just over three-quarters of the working respondents are women, roughly representative of workers in the sector as a whole.